|

The World Currency Unit (WCU), or alternatively and perhaps more accurately, the “Global Purchasing Power Unit”(GPU), is an indexed unit of account that stands for a unit of real global purchasing power. Proposed by Lok Sang Ho in a paper in World Economy in 2000 when he was a Professor of Economics at Lingnan University, Hong Kong, it was first intended to be the basis for denominating global bonds. Such bonds can serve as a reserve asset and offer the advantages of proofing against inflation and exchange risk containment at the same time. Since then the conceptual paper has grown into a project to demonstrate its workability. A website was developed based on several experimentations with alternative formulae, ending up with annual reweighting of the underlying currency basket. The website at first offered daily quotations of the benchmark basket as well as the inflation-indexed basket in 10 currencies. It was extended to 20 currencies. A recent paper by Ho (2018) provides more details.

Irving Fisher in his 1911 book The Purchasing Power of Money had advised that the purchasing power of money should be stable if it is to serve as a unit of account, a trusted medium of exchange, and a reliable store of value. Unfortunately, substances that exist by the bounty of nature, such as gold or silver, cannot have such property since their values fluctuate with changing supply and demand. This is the motivation behind all indexed units of account, of which Robert Shiller of Yale University is a principal proponent.

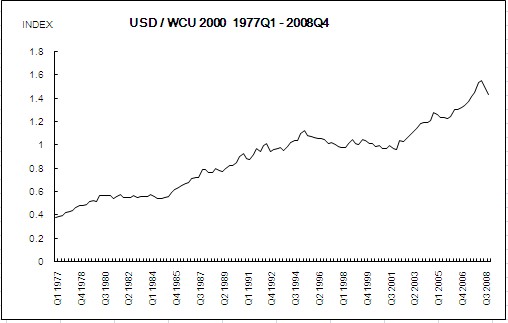

To be meaningful as a unit of standard real global purchasing power, a WCU will have to represent a basket of global output. According to the initial proposal by Ho, the WCU(0) is a basket of the gross domestic products of key market economies in the world in base year 0, namely the USA, the Eurozone and UK, Japan, Canada, and Australia. Addition of these GDPs, each in its own currency, is done by converting all GDPs into US dollar values in the base year. It can be demonstrated that this is equivalent to a basket of the six currencies each weighted by the respective GDP of the countries concerned and indexed against inflation. When the WCU was first designed, one WCU in the base year is worth $100 in the base year. Since 2009 we have redefined the size of the WCU so it is equal to US$1 in the base year.

We have been reporting quotations of the WCU2005(i.e., WCU with base year 2005) and the related 6-currency basket until 2017. We have now added the RMB to the original 6-currency basket. Thus the WCU2015 is based on a basket of 7 currencies. 2015 is the new base year. The WCU2005 series is still available for download, but has been discontinued as of 2018.

We argue that since each WCU by design represents a unit of real purchasing power, using the WCU to denominate bonds improves the transparency of real interest rates, as the stipulated interest rate on WCU-denominated bonds already represents a real interest rate. In principle, the common denomination of bonds by issuers from different parts of the world using the WCU will produce more efficient capital markets, as savers and borrowers around the world converge in their understanding of what each basis point of interest means. Likewise we recommend quotations of commodities in the WCU. Settlement can be made in any currency as per the equivalent value in that currency according to the fair value of the WCU in the currency. For further explanations, please refer to Ho (2018).

Acknowledgments: This website was developed and launched in 2008 at Lingnan University with the support of the Master of International Banking and Finance Programme of Lingnan University. Mr. Rui Yuanqing, Owen, then MIBF student, designed the first generation of the website. Gary Wong, Songbin Lai, Andy Chu, Natalie Tai, Ronald Hung, Wilson Fung and Yang Xu have assisted in various studies incidental to this project. The latest work incorporating the RMB into the basket and the associated tests that contributed to Ho (2018) was completed when Prof. Ho was with Chu Hai College of Higher Education. Support from the RGC-IDS grant UGC/IDS13/16 is acknowledged.

We apologize that there was a period when our website was out of service. This was related to the migration of the website back to Lingnan University. We thank the support of the ITSC of Lingnan and the IT staff of Chu Hai in facilitating this.

We also would thank Frasertec Limited which offered programming support to refine the website and XE.com for the data feed services.

References:

Ho, Lok Sang (2000) “Towards a New International Monetary Order: The World Currency Unit and the Global Indexed Bond”, The World Economy, 23:7, 939-950.

Ho, Lok Sang (2009) A Proposed International Unit of Account: Implications for Financial Markets, Commodity Markets, and Research, CPPS Working Paper Number 194, Lingnan University.

Ho, Lok Sang (2012) “Globalization, Exports, and Effective Exchange Rate Indices,” Journal of International Money and Finance. 31(5) 996–1007

Ho, Lok Sang (2018) In search of a unit of stable global purchasing power, International Review of Economics and Finance. 56 (2018) 99–108.

Coats, Warren(1989) "In Search of a Monetary Anchor : A 'New' Monetary Standard," IMF Working Paper No. 89/82.

Fisher, Irving(1911) The Purchasing Power of Money: Its determination and relation to credit, interest and crises.

Shiller, Robert (2003) The New Financial Order: Risk in the 21st Century, Princeton University Press.

|